- For the fourth consecutive month, Greater China Funds have posted positive average returns. Total average returns over the past 4 months for for Greater China Funds stands at 7.70%!

- Find out which fund under Equity Malaysia has occupied the number One Ranking under the "4 Weeks Gain/Loss Ranking" for 3 consecutive months!

- Find out which fund has managed to gain an astounding 19.94% since 1st January 2014!

- Find out funds from Eastspring Investments that have managed to break through the Top 10 under Equity Malaysia category.

To find out all the above, check out this months review of the Top 10 Best Performing Unit Trust Funds As of 14 August 2014.

Note : If this is your first time reading this review, I would highly recommend that you read "A Guide Towards Understanding Unit Trust Performance Table" before proceeding. Seriously you should!

Review

Fund Category : Equity Malaysia

a) Top 10 Best Performing Fund for Category Equity Malaysia (Ranked According to 5 Year Annualized Return):

Top Performer based on 5 Year Performance

5 Years Annualised Ranked 1 (Non-Islamic)

- Kenanga Growth Fund (+23.53% per annum)

5 Years Annualised Ranked 1 (Islamic Equity)

- Kenanga Syariah Growth Fund (+18.55% per annum)

Top Performer based on Yield To Date (YTD) Performance

YTD Ranked 1 (Non-Islamic)

- Kenanga Growth Fund (YTD : +19.94%)

YTD Ranked 1 (Islamic)

- Eastspring Investments Dana Al-Ilham (YTD : +12.62%)

b) 4 Weeks Gain/Loss Ranking Table for Category Equity Malaysia Funds:

|

Fund Name

|

YTD as of

14th Aug 2014 |

YTD as of

12th Sept 2014 |

4 Weeks

Gain / Loss (%) |

4 Weeks Gain/

Loss Rankings |

Previous

4 Weeks Gain/Loss Rankings |

|

Kenanga Growth Fund

|

19.15

|

19.94

|

0.79

|

1

|

1

|

|

Phillip Master Equity

Growth Fund

|

9.36

|

9.61

|

0.25

|

2

|

3

|

|

Kenanga Syariah Growth

Fund

|

8.51

|

8.14

|

-0.37

|

4

|

7

|

|

CIMB-Principal Wholesale

Equity Fund

|

12.52

|

12.45

|

-0.07

|

3

|

2

|

|

MAAKL-HDBS Flexi Fund

|

6.5

|

5.16

|

-1.34

|

6

|

8

|

|

Areca Equity Trust Fund

|

Newcomer

|

18.21

|

N/A

|

N/A

|

N/A

|

|

Eastspring Investments

Equity Income Fund

|

Newcomer

|

9.55

|

N/A

|

N/A

|

N/A

|

|

Eastspring Investments

Dana Al-Ilham

|

Newcomer

|

12.62

|

N/A

|

N/A

|

N/A

|

|

RHB-OSK Malaysia DIVA

Fund

|

6.81

|

6.08

|

-0.73

|

5

|

5

|

|

Kenanga Growth

Opportunities Fund

|

15.3

|

12.82

|

-2.48

|

7

|

9

|

|

AVERAGE 4 WEEKS GAIN/LOSS (%)

|

-0.56

|

||||

Best Performing Fund over 4 weeks period:

- Non Syariah : Kenanga Growth Fund (+0.79%)

- Syariah : Kenanga Syariah Growth Fund (-0.37%)

Worst Performing Fund 4 weeks period:

- Non Syariah : Kenanga Growth Opportunities (-2.48%)

- Syariah : MAAKL-HDBS Flexi Fund (-1.34%)

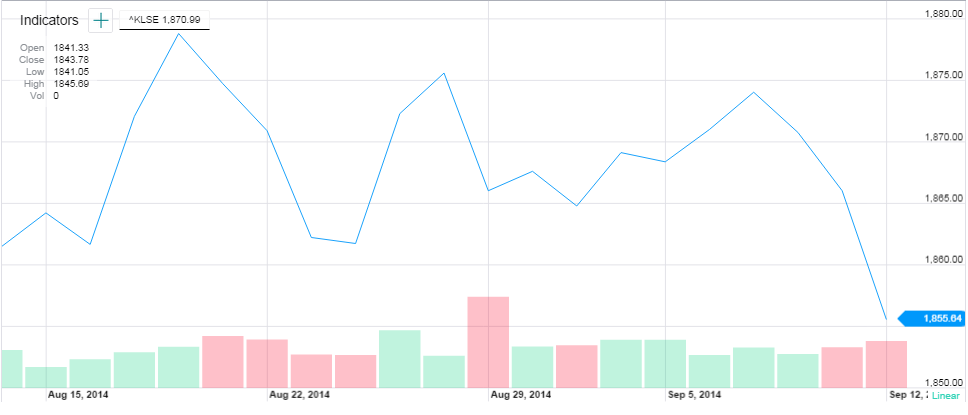

c) Performance Comparison with the KLSE Index between 14 Aug 2014 to 12 Sept 2014

KLSE Index (%) Gain/Loss : -0.32%

Comparison With:

- Average Top 10 Unit Trust Equity (%) Gain/Loss : -0.56% (Under performed the KLSE Index)

- Non Syariah - Kenanga Growth Fund : +0.79% (Out performed the KLSE Index)

- Syariah - Kenanga Syariah Growth Fund : -0.37% (Under performed the KLSE Index)

Review

Fund Category : Asia excluding Japan

a) Top 10 Best Performing Fund for Category Asia Exc Japan (Ranked According to 5 Year Annualized Return):

a) Top 10 Best Performing Fund for Category Asia Exc Japan (Ranked According to 5 Year Annualized Return):

Top Performer based on 5 Year Performance

5 Years Annualised Ranked 1 (Non-Islamic)

- Eastspring Investments Asia Pacific Equity MY Fund (+4.09% per annum)

5 Years Annualised Ranked 1 (Islamic Equity)

- Public Islamic Asia Dividend Fund (+7.28% per annum)

Top Performer based on Yield To Date (YTD) Performance

YTD Ranked 1 (Non-Islamic)

- Eastspring Investments Asia Pacific Equity MY Fund (YTD : +9.78%)

YTD Ranked 1 (Islamic)

- Pheim Asia Ex-Japan Islamic Fund (YTD : +9.97%)

b) 4 Weeks Gain/Loss Ranking Table for Category Asia Exc Japan Funds:

|

Fund Name

|

YTD as of

14th Aug 2014 |

YTD as of

12th Sept 2014 |

4 Weeks

Gain / Loss (%) |

4 Weeks Gain/

Loss Rankings |

Previous

4 Weeks Gain/Loss Rankings |

|

Public Islamic Asia

Dividend Fund

|

3.19

|

1.77

|

-1.42

|

5

|

5

|

|

Pheim Asia Ex-Japan

Islamic

|

12.02

|

9.97

|

-2.05

|

9

|

1

|

|

Public Asia Ittikal Fund

|

2.96

|

1.46

|

-1.5

|

6

|

3

|

|

Eastspring Investments

Asia Pacific Equity MY Fund

|

9.51

|

9.78

|

0.27

|

1

|

2

|

|

PB Islamic Asia Equity

Fund

|

4.44

|

2.52

|

-1.92

|

8

|

4

|

|

Hwang Select Asia (Ex

Japan) Opportunity Fund

|

7.64

|

5.8

|

-1.84

|

7

|

7

|

|

PB Islamic Asia Strategic Sector Fund

|

3.89

|

2.77

|

-1.12

|

3

|

6

|

|

Eastspring Investments

Asia Pacific Shariah Equity Fund

|

-0.8

|

-1.98

|

-1.18

|

4

|

8

|

|

AmCumulative Growth

|

Returning

|

0.51

|

N/A

|

N/A

|

N/A

|

|

Hong Leong Asia-Pacific

Dividend Fund

|

5.23

|

4.8

|

-0.43

|

2

|

N/A

|

|

AVERAGE 4 WEEKS GAIN/LOSS (%)

|

-1.24

|

||||

Best Performing Fund over 4 weeks period:

- Non Syariah : Eastspring Investments Asia Pacific Equity MY Fund (+0.27%)

- Syariah : PB Islamic Asia Strategic Sector Fund (-1.12%)

Worst Performing Fund over 4 weeks period:

- Non Syariah : Hwang Select Asia (Ex Japan) Opportunity Fund (-1.84%)

- Syariah : Public Asia Ex-Japan Islamic (-2.05%)

c) Performance Comparison with the MSCI Asia Excluding Japan Index between 14 Aug 2014 to 12 Sept 2014

MSCI Asia Exc Japan Index (%) Gain/Loss : -0.84%

Comparison With:

- Average Top 10 Unit Trust (%) Gain/Loss : -1.24% (Under performed the MSCI Index)

- Non Syariah - Eastspring Investments Asia Pacific Equity MY Fund : +0.27% (Out performed the MSCI Index)

- Syariah - PB Islamic Asia Strategic Sector Fund : -1.12% (Under performed the MSCI Index)

Review

Fund Category : Greater China

Top 10 Best Performing Fund for Category Greater China (Ranked According to 5 Year Annualized Return):

Top 10 Best Performing Fund for Category Greater China (Ranked According to 5 Year Annualized Return):

Top Performer based on 5 Year Performance

5 Years Annualised Ranked 1 (Non-Islamic)

- CIMB-Principal Greater China Equity Fund (+4.10% per annum)

5 Years Annualised Ranked 1 (Islamic Equity)

- Public China Ittikal Fund (+1.11% per annum)

Top Performer based on Yield To Date (YTD) Performance

YTD Ranked 1 (Non-Islamic)

- CIMB-Principal Greater China Equity Fund (YTD : +7.04%)

YTD Ranked 1 (Islamic)

- Public China Ittikal Fund (YTD : +6.91%)

b) 4 Weeks Gain/Loss Ranking Table for Category Greater China Funds:

b) 4 Weeks Gain/Loss Ranking Table for Category Greater China Funds:

|

Fund Name

|

YTD as of

14th Aug 2014 |

YTD as of

12th Sept 2014 |

4 Weeks

Gain / Loss (%) |

4 Weeks Gain/

Loss Rankings |

Previous

4 Weeks Gain/Loss Rankings |

|

CIMB-Principal Greater

China Equity Fund

|

5.31

|

7.04

|

1.73

|

2

|

9

|

|

Pacific Focus China Fund

|

4.47

|

4.65

|

0.18

|

6

|

5

|

|

Public China Ittikal Fund

|

7.51

|

6.91

|

-0.6

|

9

|

10

|

|

PB China Pacific Equity

Fund

|

3.35

|

3.97

|

0.62

|

4

|

1

|

|

PB China Titans Fund

|

4.46

|

4

|

-0.46

|

7

|

2

|

|

Public China Select Fund

|

4.32

|

4.66

|

0.34

|

5

|

4

|

|

MAAKL Greater China Fund

|

0.84

|

0.35

|

-0.49

|

8

|

6

|

|

AmIslamic Greater China

|

-0.64

|

0.8

|

1.44

|

3

|

8

|

|

Eastspring Investments

Dinasti Equity Fund

|

1.56

|

0.37

|

-1.19

|

10

|

7

|

|

Manulife Investment -

China Value Fund

|

1.19

|

3.61

|

2.42

|

1

|

3

|

|

AVERAGE 4 WEEKS GAIN/LOSS (%)

|

0.40

|

||||

Best Performing Fund over 4 weeks period:

- Non Syariah : Manulife Investment - China Value Fund (+2.42%)

- Syariah : AmIslamic Greater China (+1.44%)

Worst Performing Fund over 4 weeks period:

- Non Syariah : MAAKL Greater China Fund (-0.49%)

- Syariah : Eastspring Investments Dinasti Equity Fund (-1.19%)

c) Performance Comparison with the Shanghai Stock Exchange (SSE) Index between 14 Aug 2014 to 12 Sept 2014

SSE Index (%) Gain/Loss : +4.91%

Comparison With:

- Average Top 10 Unit Trust Equity (%) Gain/Loss : +0.40% (Under performed the SSE Index)

- Non Syariah - Manulife Investment - China Value Fund : +2.42% (Under performed the SSE Index)

- Syariah - AmIslamic Greater China : +1.44% (Under performed the SSE Index)

*******************

That's all for this review folks!

Cheers and Happy Investing!

Like to Invest in Top Performing Funds such as

1. Kenanga Growth Fund

2. Kenanga Syariah Growth Fund

3. Eastspring Dana-Al Ilham

and also invest at a Lower Sales Charge of 2%?

Then feel free to contact shanesee03@gmail.com for further questions and advice!

No comments:

Post a Comment