Ever wondered how Employees Provident Fund (EPF) was able to declare a dividend of 6.75% in 2014? As a matter of fact, this was the highest ever dividend declared since year 2000! The last we notice a dividend higher then this was in 1999 where 6.80% was declared thanks to the recovery of the local stock market from the 1998 Asian Financial Crisis.

The amazing thing about EPF is their ability to consistently generate dividend regardless of the stock market sentiment. Take a look at this comparison between EPF return vs KLCI return between 1986 to 2008:

|

| Data from i3investor |

As you can see, regardless of the ups and downs of the KLCI, EPF has consistently generate positive returns. Clearly such consistency from a fund with billions under its management is unrivaled anywhere else.

6.75% dividend despite a falling KLSE Index in 2014?

Now if we take a look at KLSE index performance in 2014, we see that the index ended 91.7 points or 4.95% lower:

|

| 2nd January 2014 - 1852.95 points 31 December 2014 - 1761.25 points Difference : -91.7 points |

With the index shedding 4.95% in 2014, how is it still possible for EPF which have large holdings in numerous local blue chips and growth companies able to generate a positive return?

|

| EPF's top 30 local equity holdings as of 31st Dec 2014: |

How EPF did it!

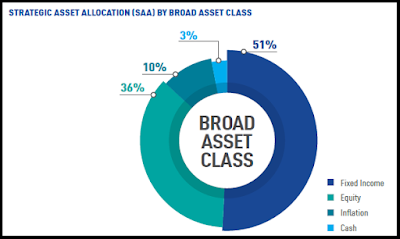

To answer the above question, let us first take a look at EPF's asset allocation in 2014:

|

| EPF 2014 Asset Allocation |

Obviously as a retirement fund, EPF has to allocate a large portion of their asset (51%) towards Fixed Income. The second largest allocation is invested into Equity asset class at 36%.

10% is allocated to "Inflation asset" where in actual fact it is made of 6% in real estates and 4% in infrastructure and natural resources. The remaining 3% is in the form of cash and money market.

10% is allocated to "Inflation asset" where in actual fact it is made of 6% in real estates and 4% in infrastructure and natural resources. The remaining 3% is in the form of cash and money market.

Equities Asset Class leading the way!

The table below indicates how each Asset Class performed in 2014:

The total ROI of Investment for all Asset Class is 7.25%.

The highlight among all asset classes is the ROI of Equities asset class which generated returns of 11.29%. The question is how did EPF manage to generate a double digit return in Equity class despite a negative performing KLSE Index?

The answer actually lies in EPF's foreign investment asset allocation and strategy.

EPF's foreign investment asset allocation and strategy!

Let's take a look at some key statistics of EPF's foreign investment data:

Statistic 1 : 23% of EPF's Asset is allocated into Foreign Investment.

In other words, out of the total managed asset of RM636.53 billion, approximately RM145.29 billion is allocated by EPF into foreign investments.

Statistic 2 : 18% of EPF's Total Managed Asset is invested into Foreign Equities

The breakdown of 23% as stated in Statistics 1:

Statistic 3 : By 2016, EPF targets 26% to be allocated into Foreign Investment

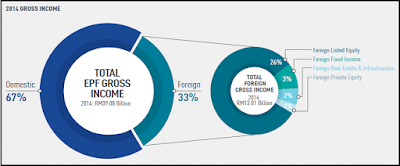

Statistic 4 : Foreign Investment contributed RM13.01 billion in Gross Income

In 2014, EPF achieved total gross income (keuntungan) of RM39.08 billion. Out of the total gross income of RM39.08 billion, RM13.01 (or 33%) is contributed by Foreign Investment.

By investing only 23% of its total asset into foreign investment, EPF was able to generate returns that make up 33% of the total gross income.

If we calculate the percentage (%) return upon invested asset we get the following numbers:

Total Foreign Investment = RM145.29 billion

Total Foreign Gross Income = RM13.01 billion

Percentage (%) Return from Foreign Investment

= (RM13.01 billion / RM145.29 billion ) x 100%

= 8.95%

As for domestic investment, the percentage (%) returns is shown below:

Total Domestic Investment = RM 491.24 billion

Total Domestic Gross Income = RM26.07 billion

Percentage (%) Return from Domestic Investment

= (RM26.07 billion / RM491.24 billion ) x 100%

= 5.31%

Statistic 5 : 18% of Total EPF Gross Income is contributed by Foreign Listed Equity

Referring back to the diagram in Statistic 4, we can see that Foreign Listed Equity is the biggest contributor of EPF's foreign income.

Now that we know the reason behind EPF's outstanding dividend declaration of 6.75% is contributed by foreign investment (specifically foreign listed equity), how would you like to find out where is EPF actually investing in? The next point will shed some light.

Find out EPF's Top 3 Foreign Investment by Markets!

EPF is investing into two main markets consisting of:

“It is also worth mentioning that EPF’s global investments this quarter had contributed 44 per cent to our total income. The strengthening of the US dollar against major currencies had enhanced returns from our global investments and further demonstrates the benefits of our diversification strategy in the light of weak domestic equity markets.”

It is clear that EPF is struggling to obtain decent returns from the domestic stock market. As a matter of fact, EPF's Equity income for Quarter 1, 2015 is largely contributed by gains from emerging and developed market as indicated in the excerpt below:

"During the quarter under review, Equities which made up 43 per cent of the Fund’s total investment assets emerged as the top investment income contributor of RM6.36 billion, representing 59.87 per cent of total income. The income generated was 31.44 per cent higher compared with RM4.84 billion recorded in the same corresponding period in 2014. The increase was mainly due to the higher income recognised in EPF’s global portfolios, capitalising on a price rally in both emerging and developed markets during the quarter."

As investor, what should you do?

Now that we know that the reason behind EPF outstanding dividend declaration is due to aggressive expansion in foreign investment, shouldn't we consider diversifying our investment into foreign market as well? Is it wise to continue investing into local stocks or unit trust that invest only in Malaysia Equities?

Perhaps some serious consideration should be given towards diversifying your investment portfolio into overseas equities like what EPF is also doing?

So you've decided to diversify into overseas equities. What are the options available?

There are a few options that you can choose when it comes to investing in overseas equities.

The highlight among all asset classes is the ROI of Equities asset class which generated returns of 11.29%. The question is how did EPF manage to generate a double digit return in Equity class despite a negative performing KLSE Index?

The answer actually lies in EPF's foreign investment asset allocation and strategy.

EPF's foreign investment asset allocation and strategy!

Let's take a look at some key statistics of EPF's foreign investment data:

Statistic 1 : 23% of EPF's Asset is allocated into Foreign Investment.

In other words, out of the total managed asset of RM636.53 billion, approximately RM145.29 billion is allocated by EPF into foreign investments.

Statistic 2 : 18% of EPF's Total Managed Asset is invested into Foreign Equities

The breakdown of 23% as stated in Statistics 1:

- 18% is invested into foreign Equity

- 3% in Bonds

- 2% in real asset and private equity

Statistic 3 : By 2016, EPF targets 26% to be allocated into Foreign Investment

|

| EPF Foreign Investment Asset Allocation Strategy |

Statistic 4 : Foreign Investment contributed RM13.01 billion in Gross Income

In 2014, EPF achieved total gross income (keuntungan) of RM39.08 billion. Out of the total gross income of RM39.08 billion, RM13.01 (or 33%) is contributed by Foreign Investment.

|

| EPF 2014 Gross Income Breakdown |

If we calculate the percentage (%) return upon invested asset we get the following numbers:

Total Foreign Investment = RM145.29 billion

Total Foreign Gross Income = RM13.01 billion

Percentage (%) Return from Foreign Investment

= (RM13.01 billion / RM145.29 billion ) x 100%

= 8.95%

As for domestic investment, the percentage (%) returns is shown below:

Total Domestic Investment = RM 491.24 billion

Total Domestic Gross Income = RM26.07 billion

Percentage (%) Return from Domestic Investment

= (RM26.07 billion / RM491.24 billion ) x 100%

= 5.31%

Statistic 5 : 18% of Total EPF Gross Income is contributed by Foreign Listed Equity

Referring back to the diagram in Statistic 4, we can see that Foreign Listed Equity is the biggest contributor of EPF's foreign income.

Now that we know the reason behind EPF's outstanding dividend declaration of 6.75% is contributed by foreign investment (specifically foreign listed equity), how would you like to find out where is EPF actually investing in? The next point will shed some light.

Find out EPF's Top 3 Foreign Investment by Markets!

EPF is investing into two main markets consisting of:

- Develop Markets

- Asia/Emerging Markets/ex-Japan

For Develop Markets, the top 3 countries are:

- United States (15.7% of Total Foreign Investment)

- United Kingdom (9.4% of Total Foreign Investment)

- Australia (4.5% of Total Foreign Investment)

- Singapore (9.4% of Total Foreign Investment)

- China (5.9% of Total Foreign Investment)

- Thailand (5.6% of Total Foreign Investment)

As a matter of fact, investment in the above 6 countries make up 50.5% of EPF's total foreign investment.

What is the reason for EPF's aggressive expansion in foreign investment?

To answer this question, I'm taking an excerpt from an announcement made by EPF Chief Executive Officer Datuk Shahril Ridza Ridzuan:

It is clear that EPF is struggling to obtain decent returns from the domestic stock market. As a matter of fact, EPF's Equity income for Quarter 1, 2015 is largely contributed by gains from emerging and developed market as indicated in the excerpt below:

"During the quarter under review, Equities which made up 43 per cent of the Fund’s total investment assets emerged as the top investment income contributor of RM6.36 billion, representing 59.87 per cent of total income. The income generated was 31.44 per cent higher compared with RM4.84 billion recorded in the same corresponding period in 2014. The increase was mainly due to the higher income recognised in EPF’s global portfolios, capitalising on a price rally in both emerging and developed markets during the quarter."

As investor, what should you do?

Now that we know that the reason behind EPF outstanding dividend declaration is due to aggressive expansion in foreign investment, shouldn't we consider diversifying our investment into foreign market as well? Is it wise to continue investing into local stocks or unit trust that invest only in Malaysia Equities?

Perhaps some serious consideration should be given towards diversifying your investment portfolio into overseas equities like what EPF is also doing?

So you've decided to diversify into overseas equities. What are the options available?

There are a few options that you can choose when it comes to investing in overseas equities.

- For stock investment, you can consider opening a foreign stock trading account (which is available via local banks or via an international online trading account). To be honest I'm not familiar with foreign stock trading account which makes it difficult for me to provide more information in terms of selecting a good trading account, what are the fees incurred as well as the charges per transaction. If you're interested to explore further into foreign stock trading account, you can try searching the internet for more information.

- On the other hand, you can also consider investing through unit trust funds that specializes into overseas investment. To get an idea on how unit trust funds are performing in markets such as China and Asia Pacific Excluding Japan, you can check out my Top 10 Best Performing Unit Trust Funds Review. Speaking of investing overseas via unit trust fund, there is an ongoing campaign by Eunittrust that offers investors an opportunity to invest into selected overseas funds for as low 0% sales charge . You can check out further information about the campaign HERE

I hope this post has helped you get a better understanding of EPF's investment approach and how this organization has continue to perform beyond expectation. This post also serves as a wake up call for us investors to not just invest into local equities. Instead we should broaden our horizon and explore the possibility of investing elsewhere.

Cheers and Happy Investing!

P.S. : If you like this post, please do share it via Facebook. Don't forget as well to give our Invest Made Easy Facebook page a big LIKE

P.P.S : Invest Made Easy wants to give you a FREE ticket to the Biggest Investment Conference in Malaysia! Click HERE for details on how to claim your FREE ticket!

P.P.P.S : Disclaimers:

P.P.S : Invest Made Easy wants to give you a FREE ticket to the Biggest Investment Conference in Malaysia! Click HERE for details on how to claim your FREE ticket!

P.P.P.S : Disclaimers:

- All data and statistics are taken from EPF's 2014 Annual Report.

- Excerpts are taken from EPF's news announcement.

- Opinions expressed are purely of my own only.