Out of the many-many Insurance Agencies available in Malaysia, you must be wondering why I selected Takaful Insurance. Well I remember reading in a magazine a couple of months ago about Takaful providing a good coverage at a lower premium compared to the rest. Well it took me till today, the eve of Chinese New Year to actually visit Takaful's website and check out what they have to offer.

Alas, instead of finding detailed information on insurance coverage and premium prices, I found myself looking at Takaful Insurance investment linked funds. While the concept of investment linked insurance has existed for quite a number of years, this is the first time I'm actually looking at the details of the insurance linked trust funds and their performance. Unluckily Luckily, Takaful's investment funds were given the honor to be reviewed by me.

Introduction

Under most circumstances, your insurance policy (regardless from which Agency) will include a small portion of your contribution into an investment vehicle. Prudential clients for example will have their insurance linked investment managed by Eastsprings Investments. On the other hand, all of Takaful's investment funds are managed internally by their Investment Division.

While insurance is a must for everyone, I must remind that one should not compare the performance of an insurance linked investment fund with that of a unit trust fund. Don't compare apples with oranges. A unit trust investment is to ensure capital growth while investing into an insurance linked investment fund is to ensure that there is additional reimbursement if an unwanted or an unforeseen circumstance were to befall upon you.

Honestly, Malaysians in general are quite oblivious to the type of insurance linked investment fund they invest in. While many dig deep into the coverage of the insurance policy, I believe almost none would inquire about the type of investment fund their contribution is being invested in. I remember when I first bought an investment linked insurance policy about 8 years ago. Apart from the coverage, all I was concerned about was to ask my insurance agent to select the investment fund with the highest return. The word "Risk" never came across my mind. How naive I was then!

Takaful Insurance Investment Linked Fund

As of December 2012, Takaful has 7 Shariah-compliant funds under their wings:

- ITTIZAN (Balanced Fund) - no more available for new investment

- ISTIQRAR (Stable Capital Fund) - no more available for new investment

- IHFAZ (Equity Index Fund)

- ITTIHAD (Growth Fund)

- ISTIFAD (Blue Chips Fund)

- IRAD (Dividend Fund)

- IHSAN (Balanced Fund)

1. ITTIZAN (Balanced Fund)

- Investment Strategy : Invest in a balanced asset allocation comprising of Shariah compliant equities and Islamic debt securities

- Asset Allocation : Equity (30% - 70%) & Sukuk/Cash (30% - 70%)

- Asset Allocation as of 31 Dec 2012 :

- Fund Performance (1st Jan 2012 - 31st Jan 2012) : 18.07%

- Fund Performance as of 31 Dec 2011 for 1 Year, 3 Year and 5 Year (Cumulative & Annualized) :

2. ISTIQRAR (Stable Capital Fund)

- Investment Strategy : Invest in a balanced asset allocation comprising mainly in Islamic debt securities with smaller exposure in Shariah-compliant equity

- Asset Allocation : Equity (up to 35%) & Sukuk/Cash (65% - 100%)

- Asset Allocation as of 31 Dec 2012 :

- Fund Performance (1st Jan 2012 - 31st Jan 2012) : 7.88%

- Fund Performance as of 31 Dec 2011 for 1 Year, 3 Year and 5 Year (Cumulative & Annualized) :

3. IHFAZ (Equity Index Fund)

- Investment Strategy : Invest mainly in the top of the Index component stocks; closely tracking the movement of the Benchmark in the medium to long term; constant rebalancing of the component stocks to closely track the benchmark performance

- Asset Allocation : Equity (90% - 95%) & Money Market (5% - 10%)

- Asset Allocation as of 31 Dec 2012 :

4. ITTIHAD (Growth Fund)

- Investment Strategy : Invest primarily in selected Shariah compliant equities that comprise of a diversified portfolio of index-linked companies, blue chip stocks and companies with growth prospects and attractive dividend yields that are listed in Bursa Malaysia. Active portfolio management - constant review on asset allocation and stocks holding. Stock/portfolio turnover would be practically high in search for opportunities in capital gain and dividend yield stocks

- Asset Allocation : Equity (50% - 95%) & Cash/Sukuk (5% - 50%)

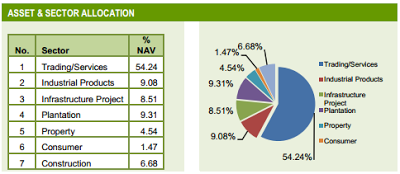

- Asset Allocation as of 31 Dec 2012 :

5. ISTIFAD (Blue Chips Fund)

- Investment Strategy : Invest primarily in Shariah compliant equities with higher market capitalisation to achieve long term capital growth; Active portfolio management - constant review on asset allocation and stock holding in search of stocks that meet the objective of the Fund

- Asset Allocation : Equity (40% - 90%) & Money Market (10% - 60%)

- Asset Allocation as of 31 Dec 2012 :

6. IRAD (Dividend Fund)

- Investment Strategy : Invest primarily in dividend yield stocks that provide a minimum annual gross dividend of 4% as well as blue-chip stocks that could potentially grow in the long run; At all times, exposure in stocks that yield a minimum of 4% annual gross dividend shall be at least 50% of the equity exposure; Constant review on asset allocation and stock holding in search of stocks that comply with the objective of the Fund.

- Asset Allocation : Equity (40% - 90%, at least 50% in dividend yield shares) & Money Market (10% - 60%)

- Asset Allocation as of 31 Dec 2012 :

7. IHSAN (Balanced Fund)

- Investment Strategy : Invest in a balanced asset allocation comprising of Shariah-compliant equity, debt securities and money market.

- Asset Allocation : Equity (10% - 40%) & Sukuk/Cash (10% - 60%)

- Asset Allocation as of 31 Dec 2012 :

- Fund Performance (1st Jan 2012 - 31st Jan 2012) : 7.88%

- Fund Performance as of 31 Dec 2011 for 1 Year, 3 Year and 5 Year (Cumulative & Annualized) :

Fund Comparison

I've compiled the performance for all 7 funds according to the latest 1 Year Returns, Annualized Returns and Risk Category as shown below:

Fund Name

|

Latest 1 Year Return

(1 Jan 12 – 31 Jan 12)

|

Annualized Returns as of 31 Jan 2011

|

Risk Category

|

||

1 Year

|

3 Years

|

5 Years

|

|||

ITTIZAN (Balanced Fund)

|

18.07 %

|

5.22 %

|

3.07 %

|

8.96 %

|

Moderate

|

ISTIQRAR (Stable Capital Fund)

|

7.88 %

|

4.45 %

|

0.69 %

|

3.81 %

|

Low/Moderate

|

IHFAZ (Equity Index Fund)

|

16.66 %

|

4.46 %

|

N/A

|

N/A

|

High

|

ITTIHAD (Growth Fund)

|

9.26 %

|

3.23 %

|

N/A

|

N/A

|

Moderate/High

|

ISTIFAD (Blue Chip Fund)

|

14.32 %

|

2.23 %

|

N/A

|

N/A

|

Moderate/High

|

IRAD (Dividend Fund)

|

17.95 %

|

6.39 %

|

N/A

|

N/A

|

Moderate/High

|

IHSAN (Balanced Fund)

|

7.88 %

|

2.56 %

|

N/A

|

N/A

|

Low/Moderate

|

Both ITTIZAN and ISTIGRAR (shaded yellow) are no more available for new investment. The remaining five funds have no 3 and 5 years performance data due to these funds being less then 3 years old.

I strongly believe when selecting a long term insurance investment fund, the following criteria should be fulfilled:

- Moderate risk.

- Annual returns higher then inflation rate.

- Annual returns higher then Fixed Deposit rate.

- Best performing fund

All three of the above criteria were matched easily by IRAD fund. Although there are better performing funds available in the unit trust market, investors who intend to take up Takaful's investment linked insurance should consider selecting IRAD (Dividend Fund) as it's investment vehicle.

Downloads

1. Takaful Investment Linked Funds Annual Report 2011

2. Fund Factsheet December 2012

Cheers and Happy Investing!

If you like this post, reward me with an ang pow by :

1. Sharing this article on your Facebook!

3. Subscribing to me! See the "FOLLOW MY ARTICLES VIA EMAIL" section located at the top left? Just key in your email and click Submit.

4. Search my blog for other related articles at http://invest-made-easy.blogspot.com/

No comments:

Post a Comment